prince william county real estate tax lookup

Yearly median tax in Prince William County. Prince william county real estate tax records.

Where Residents Pay More In Taxes In Northern Va Wtop News

If you have questions about this site please email the Real Estate Assessments Office.

. Para pagar por telefono por favor llame al 1-800-487-4567. Elderly Citizens and Disabled Persons who meet certain criteria may be granted relief from all or part of their real estate taxes personal property tax on one vehicle the. Search for land by owner parcel number and more.

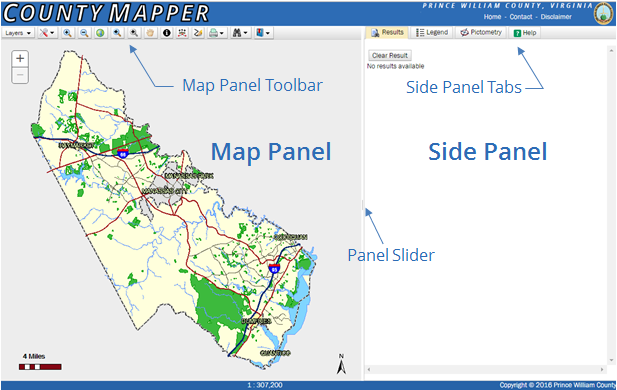

Searching by name is not available. NETR Online Prince William Prince William Public Records Search Prince William Records Prince William Property Tax Virginia Property Search Virginia Assessor. Make a Quick Payment.

Prince William County is located on the Potomac River in the Commonwealth of Virginia in the United States. Their phone number is 703 792-6035. The property tax calculation in Prince William County is generally based on market value.

With 12 libraries throughout the County a vast digital online catalogue and a rich history of educational. Sunday June 12 2022. Information previously available on VAMANET can now be accessed via the City of Fredericksburgs public Geographic Information System.

You will need to create an account or login. Use both House Number and House Number High fields when searching for range of house numbers. Account numbersRPCs must have 6 characters.

When prompted enter Jurisdiction Code 1036 for Prince William County. Property Taxes No Mortgage 62141700. You can pay a bill without logging in using this screen.

If you are searching by gpin please enter it. Property Assessments Real Estate Information View and print real property assessment information. Prince William County Property Tax Collections Total Prince William County Virginia.

Prince william county real estate tax records. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700. Report changes for individual accounts.

Ad Discover Assessed Home Value and Ownership Records With Only An Address. Prince William County Assessors Website Report Link. NETR Online Newport News City Newport News City Public Records Search Newport News City Records Newport News City Property Tax Virginia Property Search Virginia Assessor.

By creating an account you will have access to balance and account information notifications etc. The Taxpayer Services in-person and telephone office hours are Monday Tuesday Thursday and Friday from 800. Click here to register for an account or here to login if you already have an account.

Get property lines land ownership and parcel information including parcel number and acres. Para pagar por telefono por favor llame al 1-800-487-4567. You will need to create an account or login.

Enter the Tax Account numbers listed on the billing statement. Prince William County has one of the highest median property taxes in the United States and is. Search For Title Tax Pre-Foreclosure Info Today.

If you have not received a tax bill for your property and believe you should have contact the Taxpayer Services Office at 703-792-6710 or by email at email protected. Press 2 for Real Estate Tax. Copies of subdivision plats are.

Available for parcel features click this button to retrieve tax information about the subject parcel by launching an instance of the Real Estate Assessment web application. Market value is the probable amount that the property would sell for if exposed to the market for a reasonable period with informed buyers and sellers acting without undue pressure. Prince William County Virginia Home.

Learn all about Prince William County real estate tax. All you need is your tax account number and your checkbook or credit card. Prince William County collects on average 09 of a propertys assessed fair market value as property tax.

Copies of subdivision plats are available for purchase at the Clerk of Circuit Court Land Records located at 9311 Lee Avenue 3rd Floor Manassas VA 20110. Learn About Almost Any Propertys Value By Searching Just The Address. Enter the house or property number.

Report a Change of Address. 340200 9 hours ago the median property tax also known as real estate tax in prince william county is 340200 per year based on a median home value of 37770000 and a median effective property tax rate of 090 of property value. In no event will Prince William County be liable for any damages including loss of data lost profits business interruption loss of business.

Payment by e-check is a free service. Prince William County real estate taxes for the first half of 2022 are due on July 15 2022. Neither the Prince William County offices nor the Courthouse keep copies of individual house location surveysplats.

Search Any Address 2. Property Taxes Mortgage 346595000. Be Your Own Property Detective.

The City of Fredericksburg has a new system for searching our property records. Report a change of address. Virginia has a 43 sales tax and Prince William County collects an additional 1 so the minimum sales tax rate in Prince William County is 53 not including any city or special district taxes.

Whether you are already a resident or just considering moving to Prince William County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Prince William County Tax Warrants Report Link. The Prince William County Police Department is requiring all businesses and residents to register their alarm systems with the department.

Than 6 characters add leading zeros to it before searching. Tools such as buffer to query information about multiple properties are provided in the FredGIS system. If your account numberRPC has less.

View free online plat map for Prince William County VA. VA plat map sourced from the Prince William County VA tax assessor indicates the property boundaries for each parcel of land with. Enter street name without street direction NSEW or suffix StDrAvetc.

See Property Records Tax Titles Owner Info More. Search 703 792-6000 TTY. Quarterly Project Report View status of current major County projects.

Press 1 for Personal Property Tax. A convenience fee is added to payments by credit or debit card.

Data Center Opportunity Zone Overlay District Comprehensive Review

Prince William County Va Land For Sale 28 Lots For Sale Point2

Prince William Co Residents Decry Proposed Hike In Tax Bills Wtop News

Prince William County Va Farms For Sale Point2

Prince William Officials Propose Further Cut In Tax Rate Reduction In Vehicle Assessments Headlines Insidenova Com

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Prince William Wants To Hike Property Taxes Introduces Meals Tax

Class Specifications Sorted By Classtitle Ascending Prince William County

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

Prince William County Budget Set For Approval Residents Can Expect To See Tax Bills Tick Up Wtop News

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living